CG Report

Good corporate governance is one of the key factors that support the efficient operation of the company while fostering confidence among shareholders, investors, stakeholders, and the general public. Recognizing its significance, the company places importance on good corporate governance, adhering to the principles of integrity, transparency, and anti-corruption. The company is committed to treating all stakeholders fairly and equitably, taking into account environmental considerations and social responsibility, as well as complying with all applicable laws, rules, regulations, and requirements. The company firmly believes that conducting business in accordance with good corporate governance principles will enhance the quality of management, strengthen investor confidence, create added value for the organization, and ultimately drive sustainable growth.

The Board of Directors has established a written corporate governance policy for the Group, serving as a guideline for directors, executives, employees, and all stakeholders. This policy has been communicated and disseminated across the group to ensure awareness and adherence in daily operations. The policy is reviewed, monitored, and evaluated at least once a year to ensure compliance with good corporate governance principles. This process is overseen by the Corporate Governance and Sustainability Committee, relevant subcommittees, the Corporate Governance Working Group, and the management team. The objective is to continuously improve and enhance corporate governance standards, aligning with best practices for listed companies and international benchmarks. Additionally, the corporate governance policy is published on the company’s website in both Thai and English.

| More Info: | The Corporate Governance Policy |

| The Code of Conduct | |

| The Corporate Governance and Sustainability Committee |

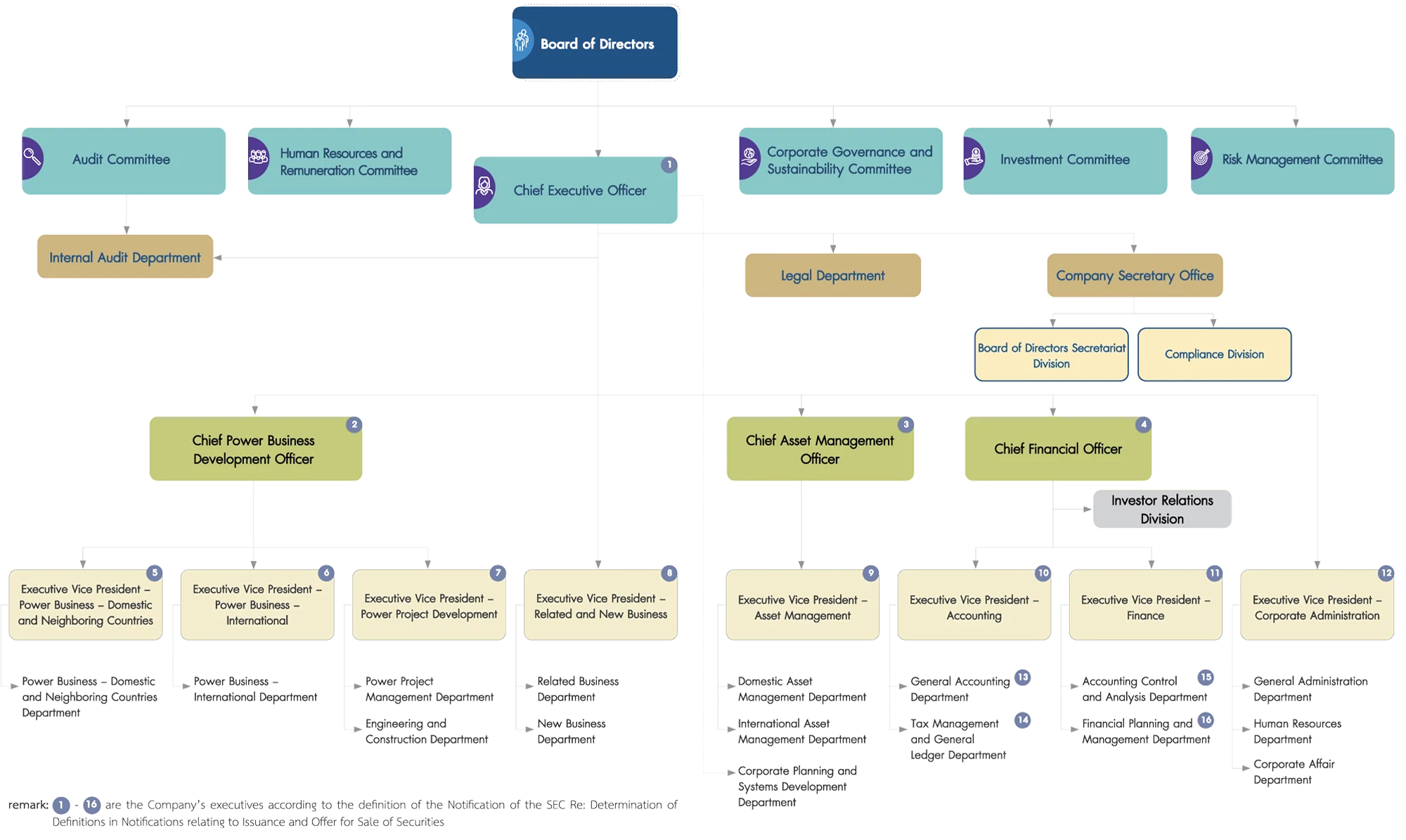

Corporate Governance Structure

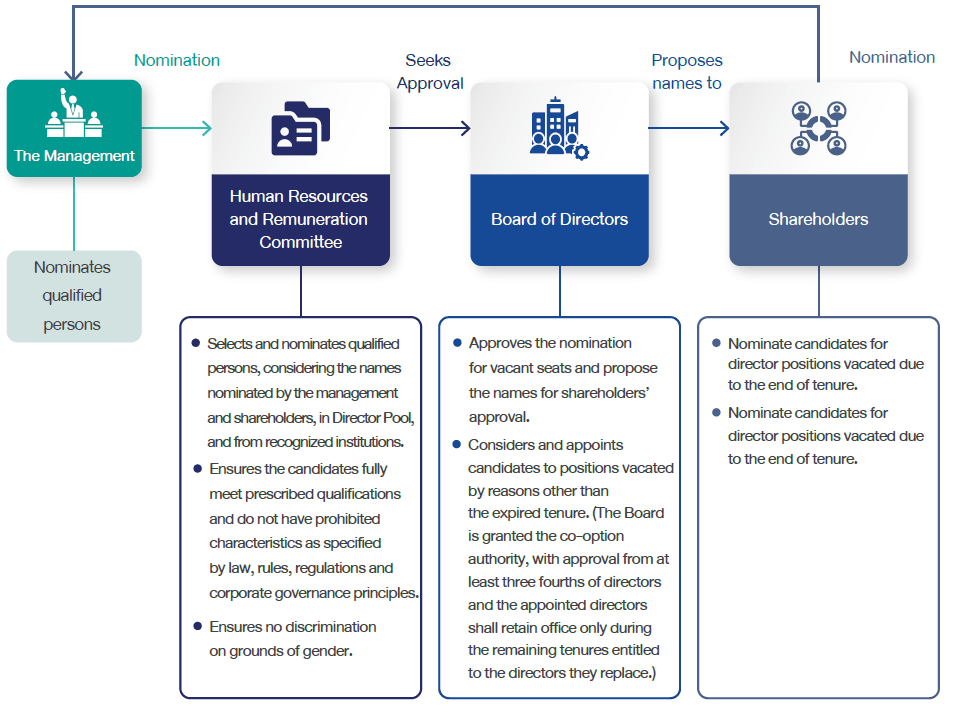

Nomination of Directors

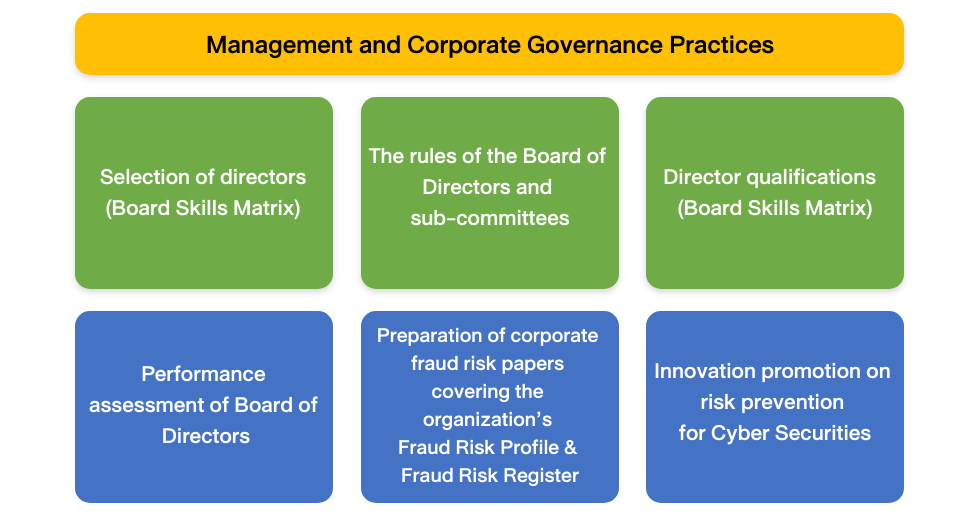

Directors are selected through the annual election process. In the process, the Management and shareholders nominate the names, without gender discrimination, for the qualification screening by the Human Resources and Remuneration Committee. Qualified candidates shall not have prohibited characteristics as specified by law and the Company’s relevant regulations as well as corporate governance principles. The Committee also takes into account the specialized expertise written in the Company's Board Skills Matrix. The list of candidates is then sent to the Board of Directors to be further submitted for the shareholders’ appointment at the Annual General Meeting.

Director Nomination Process

Director qualifications

Aside from the review of director candidates’ desirable characteristics, RATCH applies the Competency Matrix in the selection and nomination process to analyze their competencies and expertise, dividing the criteria into Core Skills Required and Alternative Skills.

| Type of Skill / Competency | Knowledge / Experience / Expertise in business or industry |

|---|---|

| Core Skills Required |

|

| Alternative Skills |

|

The Board of Directors determines that the composition of the Board of Directors must consist of directors with experience in electricity, energy and/or infrastructure business at least 3 persons and qualifications, skills and/or experience in accounting/finance at least 1 person and legal at least 1 person. As for other qualifications, skills and/or experience, the Human Resources and Remuneration Committee and the Board of Directors will consider as necessary and appropriate to align with the Company’s missions and goals.

Performance Assessment of the Board of Directors

RATCH has specified the annual performance assessment criteria for each sub-committee, which is conducted on the “as a whole” and “individual” basis.

| Criteria for Board of Directors | Criteria for Sub-committees |

|---|---|

|

|

Preparation of Corporate Fraud Risk Papers

Regarding fraud risk management, the Company has assessed fraud risk by preparing corporate fraud risk papers that covered the organization’s fraud risk profile and fraud risk register, consisting of 4 main steps as follows:

- Preparation for identifying the impact and likelihood of occurrence, as well as classifying the risk appetite

- Identification of fraud risk, root causes and impacts of risk, as well as analyzing the severity and risk probabilities before considering for the present internal control measures

- Assessment of the present internal control system, analysis of severity and risk probabilities after implementation of internal control measures

- Proposing risk mitigation measures at acceptable levels if the present internal control measures is deficient to prevent the fraud risk

In this regard, the fraud risk assessment and risk management plan are monitored and reviewed for executives and the Board of Directors’ consideration on regular basis.

Anti-Fraud and Corruption

RATCH is committed to conducting business with transparency, fairness, and responsibility towards society, the environment, and all stakeholders, in accordance with good corporate governance principles and business ethics. This commitment aligns with the Company’s policy and determination to combat all forms of corruption.

In line with this, the Board of Directors approved the Company’s participation in the Thai Private Sector Collective Action Against Corruption (CAC). The Company has been a certified CAC member since 2016 and has continuously renewed its certification. Lately, on 14 October 2024, the Company received approval for its third consecutive certification renewal.

The Board of Directors has established an anti-corruption policy framework, corruption risk management measures, and an internal control system. Responsibilities, operational guidelines, and requirements for relevant parties have been clearly documented. The Company regularly reviews its policies and updates regulations and the Company’s order related to corruption risk management to ensure they remain current and aligned with the minimum requirements set forth in the additional announcements by the CAC Council. One of the key updates includes specifying the timeframe for investigating complaints. The Company regularly reviews and updates its Corruption Risk Assessment and control measures for both the Company and its subsidiaries (RG). These serve as clear operational guidelines to prevent fraud and corruption across all business activities, ensuring sustainable business growth and development. The Company effectively communicates these policies to stakeholders through appropriate channels, ensuring strict compliance. Under the supervision of the Board of Directors, the Corporate Governance and Sustainability Committee, the Audit Committee, and the management team, the organization’s leadership plays a crucial role in demonstrating a strong stance against corruption. This commitment reinforces trust among employees, business partners, and the public in the integrity of the Group’s operations.

| Key Principles of Anti-Fraud and Corruption Policy |

|---|

|

| Anti-Fraud Corruption Policy |

| Fraud Risk Management |

Information Technology Security Risks Protection

RATCH gives priority to cybersecurity and the management of risks in terms of personnel, processes and information technology, getting prepared to counter cyberattacks and ensure business continuity and stability. Best practices are outlined, in line with cybersecurity requirements and recognized security standards, to protect computers, the network, application software, key systems and data from digital threats. RATCH has also developed a system to protect the information technology system from incidents, response measures, and a risk management system based on incidents experienced by the Company and other companies. These initiatives are prepared to prevent impacts on the operations and finance as well as stakeholders’ confidence.

RATCH has enforced the Information Technology Security Policy with an objective to safeguard the confidentiality, integrity, and availability of information. The policy also entails authenticity, accountability, non-repudiation, and reliability. The Company also imposes the Computer and Network Usage Policy that specifies guidelines on computer and network management. The two policies are the tools to ensure IT security, and cybersecurity and business continuity. The policies are reviewed at least once a year or when a severe incident occurs and affects the security.

Data Privacy Implementation and Monitoring

The Company implemented the One Trust platform for managing personal data to ensure that relevant stakeholders' data is thoroughly and efficiently protected, while compliance to all aspects of the law is completed. Additionally, the company is ongoing to monitor the use of employees, suppliers, customers and relevant stakeholders' personal data of all business units.

| IT Incident Management Workflow |

| Information Technology Security Policy |

| Computer and Network Usage Policy |

The Company has executed the corporate governance practices aligning with the business and changing situations which are summarized as follows:

1. Rights of Shareholders

The Company continuously complies with the good corporate governance policies. The Company focuses on providing shareholders with fundamental rights, fair and equal treatment. These include the rights to attend shareholders meeting; propose agenda items and/or nominate people to be directors in shareholders’ meeting; express opinions and ask questions in shareholders’ meeting; appoint a proxy to attend the meeting and vote on their behalf; receive dividends; elect, remove, and determine remuneration of directors; appoint the auditor and determine the auditor’s fee; vote on important activities such as increasing or decreasing capital, acquisition or disposal of important assets, making related transactions, etc.; register of share ownership; change of owner or transfer of rights in shares; and receive significant information that is accurate, adequate, and timely. Therefore, the Board of Directors establishes and announces shareholder policies, as well as promotes and protects the rights of all groups of shareholders equally.

In 2024, the Company was not subject to any fines, charges, or civil actions by regulatory authorities concerning share repurchases, restrictions on shareholder communication, or non-disclosure of shareholder agreements that could have a material impact on the company or other shareholders.

- Rights to attend the shareholders’ meeting

The Company has established policies and practices to facilitate and encourage all groups of shareholders to exercise their fundamental rights to participate in meetings and vote on significant matters equitably. Additionally, shareholders are provided with the opportunity to be informed about and monitor the performance of the Board of Directors and the management on an annual basis. The Board of Directors ensures that the Shareholders’ Annual General Meeting (AGM) held within four months from the end of the Company’s fiscal year. In cases where urgent matters require shareholders’ approval on an extraordinary basis, the Board of Directors may convene an Extraordinary General Meeting (EGM) as necessary.

- Right to appoint a proxy for meeting attendance and voting

The Company grants shareholders the right to appoint a proxy who has reached legal age to attend the meeting and vote on their behalf. The proxy must be designated using the official proxy form prescribed by the registrar. The appointed proxy is required to submit the completed proxy form to the Chairman of the Board of Directors, or a person designated by the Chairman, before attending the meeting.

- Right to receive dividends

The Company has established a dividend payment policy to distribute at least 40% of net profit, based on the consolidated financial statements, after deducting legal reserves and other required reserves. However, the actual dividend payment is subject to the Company’s cash flow position. For the 2024 annual dividend payment, the Company set the Record Date on 18 March 2024, to determine shareholders eligible to attend the Shareholders’ Annual General Meeting (AGM), vote, and receive dividends. The dividend payment date was scheduled for 23 May 2024. The Company announced the dividend payment notice on its website in both Thai and English for three consecutive days, from 24 to 26 April 2024, in compliance with legal requirements and the Company’s Articles of Association. Details were provided in the meeting invitation sent to shareholders.

To protect shareholders’ rights, the Company regularly reviews and monitors dividend payments each year. The Company identified accrued dividend payments that some shareholders have not yet collected. To address this, the Company has sent official notices to shareholders using the Registrar’s database, providing details on unclaimed dividends and instructions on how to claim them; assisted shareholders in reissuing dividend checks in cases where checks were lost or expired; and facilitated the transfer of share ownership and dividend payments to heirs in cases where shareholders have passed away.

Additionally, the Company has encouraged shareholders to enroll in the e-Dividend service by sending them the registration form. This service allows dividends to be directly transferred to shareholders’ bank accounts, ensuring convenience, speed, and security for future dividend payments. Currently, there is a growing trend among shareholders opting for e-Dividend payments.

- Right to elect, remove and determine directors’ remuneration

The Board of Directors proposes to the shareholders’ meeting to consider the election of directors to replace those retiring on rotation. The names and brief profiles of each nominated director are fully disclosed in the meeting invitation for shareholders’ consideration. Additionally, the remuneration of directors is proposed for annual approval by the shareholders.

- Voting for Directors: The Company’s Articles of Association stipulate that the election of directors shall be carried by a majority vote of the shareholders present at the meeting and voting. In every vote, a shareholder has a vote equal to the number of shares he or she holds, assuming that one share has one vote, therefore, there is no cumulative voting.

- Right to appoint the auditor and determine audit fees

The Board of Directors submits to the shareholders’ meeting an annual proposal for the appointment of external auditors and the determination of audit fees for approval. The proposal includes names of the auditor and affiliated audit firm, experience and qualifications, independence and potential conflicts of interest, detailed breakdown of audit fees and related service charges.

- Right to register ownership, transfer, or assign shareholding rights

The Company has appointed the Thailand Securities Depository Company Limited (TSD) as its securities registrar, responsible for depositing the Company’s securities, maintaining shareholder records to ensure they are always up to date, providing various shareholder services, including issuance of share certificates, depositing/withdrawing securities certificates, transferring of securities, and providing processing shareholder benefits. Shareholders can directly contact TSD for assistance via the TSD Call Center at +66 2009 9999 or register for the Investor Portal, an online shareholder service platform, at: https://www.set.or.th/en/tsd/overview

- Right to receive material information accurately, sufficiently, and in a timely Manner

The Company complies with all regulations, criteria, conditions, and procedures related to the disclosure of information and any relevant actions required for listed companies. It ensures that all material information is disclosed completely, accurately, sufficiently, and in a timely manner.

- Right to participate in the Company’s activities

The Company organizes business site visits for its group companies, both domestically and internationally, providing opportunities for minority shareholders and institutional investors to participate. These site visits are held annually, with participants selected through a randomized system from among investors who register under the Company’s specified criteria. Additionally, the Company facilitates other shareholder engagement activities through online platforms, including Opportunity Day, Analyst Meetings, and Press Conferences, etc.

2. Equitable Treatment of Shareholders

The Company treats all shareholders equally, regardless of whether they are major shareholders, minority shareholders, or institutional investors, and irrespective of their nationality, whether Thai or foreign. The key principles can be summarized as follows:

-

Access to the Company’s information

The Company designates the Stock Exchange of Thailand (SET) information disclosure system as its primary channel for public disclosures. The authorized persons responsible for disclosing company information include the Chairman of the Board of Directors, Directors, Chief Executive Officer, and Chief Officers. Additionally, the Company provides alternative communication channels to ensure equal access to information for all shareholders through the Company’s website, and responsible units such as the Company Secretary Office, Internal Audit Department, Corporate Affairs Department, and Investor Relations Division, etc.

-

Bilingual Documentation

The Company provides all disclosures and corporate information in both Thai and English through the Stock Exchange of Thailand (SET) information disclosure system and the Company’s website. This ensures that both Thai and foreign shareholders have equal access to the Company’s information.

-

Encouraging minority shareholders to propose meeting agenda and/or nominate directors

At every Shareholders’ Annual General Meeting (AGM), the Company publishes information inviting minority shareholders to propose agenda items for inclusion in the shareholders’ meeting and/or nominate individuals for election as directors through the SET information disclosure system. The Company clearly publishes the criteria, procedures, evaluation process, and submission channels on its website.

-

Right to appoint a proxy for meeting attendance

The Company has provided Proxy Forms A, B, and C to shareholders along with the meeting invitation, with a recommendation to use Proxy Form B. The proxy forms include detailed instructions on the required supporting documents for proxy appointments, as well as simple and straightforward conditions to facilitate the process. This ensures that shareholders who are unable to attend the meeting in person can appoint another individual to attend and vote on their behalf. Shareholders can download the proxy forms from the Company’s website. They also have the flexibility to use alternative proxy forms or create their own based on their convenience and discretion.

To further enhance convenience and support electronic proxy voting, shareholders who wish to use the e-Proxy Voting system provided by the Thailand Securities Depository (TSD) can submit their voting instructions electronically via the Investor Portal. With the e-Proxy Voting system, shareholders are not required to submit physical documents or mail the proxy form to the Company.

At the 2024 Shareholders’ Annual General Meeting (AGM), the Company nominated two independent directors as options for shareholders to appoint as their proxies to attend the meeting and vote on their behalf namely Mr. Praphaisith Tankeyura and Mr. Panuwat Triyangkulsri. The Company provided shareholders with detailed information on each nominee, including their vested interest in the agenda items. A total of 196 shareholders appointed the two independent directors as their proxies.

-

Electronic voting

The Company requires that all voting during the shareholders’ meeting be conducted electronically. All participants can cast their votes in real-time by entering Username and Password to verify their identities via computer, mobile phone, or tablet. This system ensures convenience for participants and allows for verifiable vote processing.

-

Prevention of abuse of inside information for personal gain

The Company has established written policies, guidelines, and operational measures to prevent the misuse of inside information for personal or third-party benefits in an improper manner. These measures are incorporated into the Company’s Code of Conduct, regulations, directives, and official announcements. The Company reviews and updates its guidelines at least once a year, following the process established by the Board of Directors. Additionally, the Company provides training and awareness programs for directors, executives, employees, and all stakeholders. It requires all relevant personnel to acknowledge and commit to these policies by signing an agreement during orientation and their first day of employment. The Company also regularly communicates and reinforces the policies, guidelines, and key preventive measures through Board of Directors’ meetings, internal communication systems, and the Company’s website.

Prevention of Misuse of Inside Information Policy Network and Computer Usage Policy Personal Data Protection Policy In 2024, no directors, executives and employees were found to have used inside information or traded securities during the period that the Company specified to refrain from trading. In addition, there is no accusation of directors and executives in the case of securities trading or using inside information for the benefit of themselves or others in an unlawful manner by the listed company regulatory agency.

-

Prevention of conflict of interest

The Company has established written policies and guidelines for preventing conflict of interest, which are incorporated into the Company’s Code of Conduct, Article of Association, and regulations governing various committees. Directors, executives, and employees must sign an acknowledgement and commit to following these policies on their first day of work and during the orientation. The Company reviews and updates conflict of interest guidelines at least once a year as per process determined by the Board of Directors.

All directors, executives, and employees must perform their duties to the best of their ability and make decisions based on the best interests of the Company, in compliance with laws and ethical standards. Any person with vested interest in any matter under consideration shall disclose the conflict of interest to the meeting, leave the meeting room, abstain from participating in the decision-making process, and have no voting right on the transaction in question. The Company regularly educates directors, executives, and employees on conflict-of-interest prevention through the Board of Directors meetings and internal communication channels such as Line application, email, etc.

Additionally, directors and executives shall also submit a vested interest report, concerning themselves and related persons, on the first day of assuming the position and whenever there is a change in their interest using the prescribed Conflict of Interest Disclosure Form. The Company Secretary is responsible for maintaining these reports and forwarding copies to the Chairman of the Board of Directors and the Chairman of the Audit Committee. Subsequent reports must be submitted at least once a year on 1 June.

Regarding subsidiaries, affiliates and joint ventures, a written procedure and guidelines are established to supervise and monitor the operations through the individuals serving as directors or executives of the entities on secondment agreements. The representatives shall follow the same set of practices. All functional chiefs are required to attend the Audit Committee’s meetings and the Board of Directors’ meetings on a regular basis, or at least once a quarter, to update the committee on the subsidiaries, affiliates and joint ventures’ operations and obstacles.

In cases where the company and/or its subsidiaries or affiliated companies engage in similar business activities, measures are implemented to prevent conflict of interest while ensuring that the best interests of the Company remain the priority.

In 2024, there were no related-party transactions or asset sales involving the Company and any business partners that had a connection to the Board of Directors, executives, or employees in a manner that presented or could present a conflict of interest.

3. Role of Stakeholders

-

Policy on stakeholders

The Board of Directors clearly sets the policy and guidelines on each stakeholder group. The Company’s Code of Conduct has been reviewed and revised to serve as a framework for directors, executives, and employees in treating stakeholders under the promotion and supervision principles. This is to ensure the legal rights of stakeholders such as shareholders, employees, customers, creditors, partners, competitors, public sectors, and communities where the Company is located are protected and treated well. The policy and guidelines are published for the acknowledgment of all on various channels and the Company’s website.

The Code of Conduct Stakeholder Engagement Policy -

Human Rights Policy

The Board of Directors has established a written Human Rights Policy and key practices within the Company’s Code of Conduct to promote awareness and commitment to respecting fundamental rights, human dignity, equality, and peaceful coexistence for sustainable social development. In 2024, the Board of Directors reviewed and updated the Company’s Code of Conduct to ensure alignment with current global human rights standards and evolving societal and business landscapes. It can be summarized as follows:

Intention: The Company is committed to upholding, supporting, and promoting the respect and protection of fundamental human rights and human dignity for all individuals involved in its operations. This commitment aligns with domestic laws, international human rights and labor standards, and best business practices. In addition, the Company encourages its joint ventures, business partners, suppliers, and other relevant stakeholders within its supply chain and managed operations, both domestically and internationally, to operate in accordance with human rights principles, respect for human dignity, and fair treatment of all stakeholders. The Company ensures equal opportunities for all individuals, non-discrimination regardless of race, complexion, gender, gender identity, age, religion, language, beliefs, social status, family origin, disability, political opinion, or other protected attributes under domestic laws and international human rights principles.

The Company conducts its business with extreme caution and due diligence to prevent human rights violations within its operations. These principles are clearly outlined in the Company’s Human Rights Policy, ensuring active participation in improving the quality of life for communities surrounding the Company’s operations on a continuous basis.

Respect for rights, freedoms, and equality: Employees must treat one another with respect and dignity, recognizing and valuing differences in opinions. It is essential to refrain from expressing opinions related to race, religion, gender, economic status, social standing, education, or any other topics that may lead to conflict, and strictly prohibit any form of harassment or oppression, whether physical or psychological, as well as any use of violence, threats, or unfair treatment of others in the workplace.

Employees have the freedom to exercise their political rights, which includes supporting or being a member of a political party, voting in elections, engaging in other lawful political activities. The Company also supports and encourages employees to voluntarily participate in group activities and engage in various initiatives.

Protection of privacy and confidentiality: Personal data is classified as confidential data. Access is strictly limited to authorized personnel who require the data for clear and legitimate business purposes. Personal data must be used only for specified, fair, and lawful purposes. Personal data is collected only as necessary and retained in compliance with legal, regulatory, or legitimate business requirements. The Company ensures strict protection of employees’ personal data held by the Company. No personal data shall be disclosed, transferred, or shared with unauthorized individuals unless explicit consent is given by the data owner. The Company ensures that employee personal data and legally defined sensitive information are strictly protected in compliance with applicable data protection laws. The Company recognizes the importance of personal data protection laws and the rights of individuals in Thailand and internationally, ensuring strict compliance, particularly in cases involving cross-border data transfers. Consult with legal advisors or data protection officers to identify and comply with the necessary legal requirements

Fair and equal treatment of workers & respect for community rights: The Company adheres to labor laws and aligns its practices with the International Labour Organization (ILO) conventions and regulations as the foundation for treating workers fairly throughout its operations. This commitment covers employment practices, employee welfare and protection, workplace safety, occupational health, and environment. The Company upholds the principles of equality and non-discrimination, ensuring fair employment practices at the local level extending the same ethical labor standards to its suppliers.

The Company respects the right of communities to access information and ensure safety, maintaining continuous engagement through various appropriate and effective communication channels. The Company actively supports and promotes the quality of life in local communities through its initiatives in education, public health, employment, and hygiene and sanitary improvement.

Human Rights Due Diligence: The Company conducts a human rights risk and impact assessment for stakeholders across its value chain every three years. In 2022, the Company conducted a Human Rights Risk Assessment employees, suppliers, customers, local communities, and other relevant rights-holders. This assessment resulted in the creation of a risk register along with risk management measures to address identified concerns. In 2023, the Company conducted a Human Rights Impact Assessment for employees of the Company, subsidiaries, and joint ventures. The results showed that the risk and impact level for employees was low, with sufficient control measures already in place.

The Company has established human rights guidelines within its Code of Conduct and actively promotes awareness and understanding of human rights among employees to ensure compliance and ethical conduct. By fostering a culture of human rights awareness, the Company aims to mitigate human rights risks that could impact stakeholder confidence and corporate reputation, ensuring long-term sustainability. In 2024, the Board of Directors conducted a review of the Company’s Human Rights Policy and determined that the key elements of the policy remain comprehensive and aligned with the UN Guiding Principles on Business and Human Rights (UNGPs) as well as the Company’s operational context.

The Code of Conduct Human Rights Policy -

Personal Data Protection Policy

To ensure compliance with the Personal Data Protection Act B.E. 2562 (2019), the Company has established and promulgated its Personal Data Protection Policy through internal communication channels and on the Company’s website. The policy aims to raise awareness of the importance of personal data protection. The collection of personal data must be limited to what is necessary for the Company’s data processing, strictly under legitimate legal purposes, purpose of data collection and storage, as well as the rights of data subjects. The disclosure of personal data must receive explicit consent from the data subject. The Company implements appropriate and adequate security measures to protect personal data. It provides communication channels for contacting the Company and a complaint-handling process for customer concerns related to personal data. These measures are regularly reviewed and monitored to ensure compliance with legal requirements.

In 2024, the Company has appointed a new Data Protection Officer (DPO). Effective 16 July 2024, Mr. Yuwasan Vivekmetakorn, Vice President – Legal, has replaced Mr. Nawapol Disathien, Executive Vice President - Corporate Administration, as the Company’s DPO.

Personal Data Protection Policy -

Intellectual Property Utilization and Protection

The Board of Directors mandates that all employees protect the Company’s intellectual property and use it exclusively for the Company’s benefit, as prescribed in the guidelines in the Company’s Code of Conduct announced and observed. Employees must respect intellectual property rights of the Company and third parties, avoid and refrain from any actions that may infringe upon the Company’s or others’ intellectual property, and cease access to and use of the Company’s intellectual property upon termination of employment.

-

Information Technology (IT) Security Policy

The Company has established a written Information Technology Security Policy to ensure compliance with legal and regulatory requirements regarding the use of computers and networks. The full policy details can be accessed on the company’s website. This policy aligns with the Computer Crime Act and includes software usage control policy, ensuring compliance with copyright laws, confidentiality management policy, access control policy, cyber-attack risk management plan based on the NIST Cybersecurity Framework from the U.S. National Institute of Standards and Technology (NIST), and crisis response plan. The Company continuously develops various internal systems for use in both in terms of information system and other departments to enhance efficiency and operational convenience. The information system is audited by both internal and external auditing agencies.

Information Technology Security Policy In 2024, in addition to routine system maintenance, the Company has focused on cybersecurity monitoring, prevention, and improvement by implementing proactive measures to safeguard critical data and maintain organizational credibility including monthly Security Scorecard assessments, Vulnerability Assessment (VA Scan). These measures align with cybersecurity standards. The Company also conducted Disaster Recovery System Testing to ensure that critical business operations can continue smoothly in the event of a crisis or emergency. If any misconduct is found to have caused damage to the Company, disciplinary action will be taken against employees, while legal action will be pursued against both employees and external parties as necessary.

4. Board of Directors Responsibilities

The Board of Directors has established policies and guidelines relating to the Board of Directors, covering the composition and qualifications of the Board of Directors, definition of independent directors, term of office, authority and duties of the Board of Directors, Board meetings, and voting. The details appear in the Company’s Regulation on the Board of Directors B.E. 2566 (2023) which is summarized as follows.

| Regulation on the Board of Directors B.E. 2566 |

- Board of Directors Structure

Organization Chart - Composition of the Board of Directors

- Not less than 7 directors and not more than 15 directors appointed by the shareholders’ meeting or the Board of Directors.

- Executive directors shall not exceed one-third of the total number of directors.

- Independent directors shall consist of at least one-third of the total number of directors and at least 3 directors.

- Not less than one-half of the total number of directors must be resident of the Kingdom of Thailand.

- The Chairman of the Board of Directors must be a non-executive director and not the same person as the Chief Executive Officer who is the top executive.

- Qualifications of Directors

- Age not over 72 years old.

- Hold a directorship not more than 3 psted companies (including directorship of the Company)

- Have no prohibited characteristics as prescribed by law, not being bankrupt, incompetent or quasi-incompetent

- Have never been imprisoned by a final judgment for an offense involving assets by committing fraudulently.

- Have never been fired or dismissed from government service or pubpc or private organizations or agencies for malpractice.

- Have never been removed from being a director, manager, employee, or management authority of other organizations.

- Not being a poptician, a member of parpament, a senator, a local councilor, or a local administrator.

- Possess educational quapfication, working experience, or other quapfications as specified by the Company.

- Independence of the Board of Directors and the Chairman of the Board of Directors

The Board of Directors consists of 12 directors: 6 independent directors and 6 shareholder representatives. As of 31 December 2024, there are a total of directors in office, with 50% of the total being independent directors, which complied with the criteria requiring independent directors to be at least one-third of the total number of directors. This ensures that directors can perform their duties as representatives of shareholders independently with the appropriate checks and balances.

The Chairman of the Board of Directors is an independent director and not an executive of the Company. Thus, he can perform his duties as the chairman independently, without dominating or guiding ideas during the discussions. All directors are encouraged to participate in discussions and fully express their opinions by allowing sufficient and appropriate time to consider and make decisions on various matters for prudence, completeness, sufficiency, and maximum benefit to the Company, resulting in independent, reasonable and efficient voting and resolutions of the meeting.

- Separation of the Chairman and Chief Executive Officer

The Chairman of the Board of Directors (Independent Director) is not the same person as the Chief Executive Officer and has no relationship with the Management. The roles, duties, and responsibilities of the Chairman of the Board of Directors and the Chief Executive Officer are clearly separated for the proper balance of power as follows:

Chairman Chief Executive officer - Being an Independent Director

- Lead and formulate the Company’s policies together with the Management through the Board of Directors’ meetings.

- Lead and control the Board of Directors’ meetings to be efficient and effective by encouraging all directors to participate in independently expressing their opinions in the meeting.

- Provide support and guidance on business operations to the Management through Chief Executive Officer.

- Serve as the Company’s top executive and the only executive director.

- Manage the Company’s business in accordance with the objectives, Articles of Association, policies, regulations of the Company and resolutions of the Board of Directors’ meeting attended by independent directors

The Board of Directors clearly defines and separates the authority and duty of the Board of Directors and the Management which can be summarized as follows:

Board of Directors Management Formulate policies and monitor the Management’s operations.

Implement the policies and report the results to the Board of Directors.

- Directorship in other companies

None of the Company’s directors holds a director position in more than 2 other listed companies, in line with the Company’s Regulations on the Board of Directors which stipulate that director must not hold directorship in more than 3 listed companies (including the Company’s directorship). This is in accordance with the SET’s recommendations in considering efficiency and time dedication in performing duties as a company director.

The appointment of directors and executives (including CEO) to sit in subsidiaries, associates, and group companies must be approved by the Board of Directors through screening by the Human Resources and Remuneration Committee according to the Company’s nomination process, which has considered qualifications, knowledge, competence, responsibilities, vision, time allocation and maximum benefits to the business as a whole. This is in accordance with the regulations regarding the supervision of subsidiaries, affiliates, and joint ventures, as clearly defined criteria for appointment and responsibilities of the Company’s representatives who are assigned as directors and shareholders in the businesses in which the Company invests to convey the policies of the Board of Directors and report the operation results of those businesses.

- Nomination of Directors

The Board of Directors has established policy, criteria, and nomination and election process of directors. The Human Resources and Remuneration Committee is assigned to nominate, screen, and select qualified persons from list of qualified persons proposed from the incumbent directors by the shareholders and persons with knowledge and competence from the Directors’ Pool of a reliable and recognized agency such as the Thai Institute of Directors Association (IOD) and Ministry of Finance’s List of State Enterprise Directors. The nomination of directors and/or independent directors will consider qualifications, diversity of knowledge and expertise, necessary and lacking skills, and experience according to the Board Skills Matrix which are consistent with the business and context of the Company with no restrictions on gender, race, and nationality. They shall not have characteristics prohibited by law and comply with rules, regulations, and the Company’s definition of independent directors, including the requirements of regulatory agencies and relevant good corporate governance principles. The Committee shall also consider the performance as the Company’s directors in the past period as well as their readiness to devote time to fully perform duties as directors in order to promote, support, and drive the performance of the Board of Directors for optimum effectiveness.

In terms of fair and equitable treatment of shareholders, the Company has given an opportunity for minority shareholders to nominate qualified persons without prohibited characteristics by laws to be elected as directors at the Annual General Meeting. The criteria, method, and procedure for consideration, and period as set by the Board of Directors are disclosed via the SET’s information disclosure system and the Company’s website. Major shareholders (EGAT) are entitled to nominate representatives as directors in proportion to their shareholding.

The Company will then consider the qualifications of the nominees as directors from both minority and major shareholders in accordance with the Company’s director nomination process before submitting to the Board of Directors and/or Shareholders’ meeting for approval depending on the cases as follows:

Case 1: When a director position becomes vacant for reasons other than retire by rotation, the Board of Directors is empowered to appoint a director for replacement and the person who replaces the vacancy shall retain in the position of director only for the remainder of the term of the director he replaces. In this case, the resolution must be approved by the Board of Directors meeting with a vote of not less than three-fourths of the remaining directors.

Case 2: When a director position becomes vacant due to retire by rotation, the Board of Directors will propose to the Annual General Meeting of Shareholders for consideration and election in accordance with the rules and procedures as prescribed in the Company’s Articles of Association.

- Secretary to the Board of Directors and Company Secretary

- Secretary to the Board of Directors

The Board of Directors appointed Chief Executive Officer as its secretary. The Board of Directors Secretariat Department under the Company Secretary Office is responsible for arranging meetings, administration and coordination for the Board of Directors.

- Company Secretary

Appointed by the Board of Directors with duties as stipulated in the Securities and Exchange Act B.E. 2535 in preparing and storing documents such as directors’ registers, meeting notices and minutes of the Board of Directors’ meeting and Annual General Meeting, Form 56-1 One Report, vested interest reports by directors and executives, and other duties defined by the Capital Market Supervisory Board. The Company Secretary holds a position of Vice President – Head of Company Secretary Office and reports directly to the Chief Executive Officer with responsibility to plan and organize the Board of Directors’ Meetings, Annual General Meetings, and activities of the Board of Directors of the Company and subsidiaries; coordinate and supervise compliance with the resolutions of the Board of Directors and Annual General Meetings, provide relevant preliminary recommendations to directors and executives to ensure that the Board of Directors’ Meetings and activities as well as the Company’s information disclosure are efficient and comply with laws, rules, regulations, policies, good corporate governance principles, and relevant regulatory requirements. The Board of Directors’ Secretary Division and Compliance Division headed by Division Manager are responsible for supervising and supporting the operations of duties and responsibilities of the Company Secretary to be in accordance with the provisions of the Securities and Exchange Act and other relevant regulations.

- Composition of the Board of Directors

- Sub-committees

The Board of Directors appointed 5 sub-committees which are the Audit Committee, the Human Resources and Remuneration Committee, the Corporate Governance and Sustainability Committee, the Investment Committee and the Risk Management Committee taking into account appropriateness and necessity to help alleviate the burden of studying details and scrutinizing specific matters and to help increase efficiency in performing duties and responsibilities of the Board of Directors.

Board of Directors - Roles, Duties and Responsibilities of the Board of Directors

- Formulate, review, endorse, and approve strategies, business plans, policies, budgets, business directions and corporate governance of the Company together with the management on an annual basis.

- Endorse and approve strategies and vision for human resource management, including executive development plans, organizational structure, remuneration structure, and remuneration plans, ensuring alignment with performance outcomes; oversee the establishment of transparent criteria, procedures, and processes for the nomination, removal, or termination of directors and high-level executives; and, ensure the effectiveness of performance evaluations for high-level executives by comparing results against mutually defined goals.

- Monitor the progress, efficiency, and success of the Company’s strategic execution, comparing both short-term and long-term performance against set targets; assess key performance indicators (KPIs) relative to industry competitors and disclose corporate performance and governance practices in accordance with good corporate governance principles in the 56-1 One Report; require management to present performance reports to the Board of Directors on a regular basis, at a minimum, as follows:

- Monthly report including performance analysis report; asset management performance report; short-term and long-term investment summary report; loan summary report; cash flow statement; progress report of projects invested by the Company; report on holding and/or change of securities holding of directors, executives, spouse, and minor children; including notification of securities trading at least 1 day in advance, and energy stock price report.

- Quarterly report including quarterly financial statement reports; minutes of the meetings of the sub-committees; Risk Management Report; and Corporate Governance and Sustainability Performance Report.

- Annual report including annual financial statements; Annual performance evaluation compared to targets; Reports on the performance of sub-committees; Report on the performance of the Board of Directors according to Form 56-1 One Report, and Annual Sustainability Report.

- Establish an effective and appropriate communication system with the Company’s stakeholders and the public.

The Board of Directors shall act in accordance with the laws, objectives, articles of association and resolutions of the shareholders’ meeting and/or may assign one or more directors or any other person to perform any action on behalf of the Board of Directors, except that the following matters may be carried out by the Board of Directors with prior approval from the shareholders’ meeting:

- (1) Matters required by law to be resolved by the shareholders’ meeting

- (2) Agreement to enter into a connected transaction or transaction relating to the acquisition or disposal of material assets of the Company or its subsidiaries within the meaning prescribed in the SET Notification applicable to the transaction of a listed company, depending on the case.

The Board of Directors must be aware of its roles, duties and responsibilities as the Board of Directors by adhering to independence in decision-making and taking into account the goals and best interests of the Company and its shareholders. In other words, all directors pay attention to and are aware of their duties to the shareholders who own the business and appoint directors to perform their duties and responsibilities in supervising the management of the business for the best interests of the shareholders (Fiduciary Duty), covering 4 important duties. These include performing their duties with care. (Duty of Care), performing duties with integrity (Duty of Loyalty), Compliance with laws, objectives, articles of association and resolutions of the shareholders’ meeting (Duty of Obedience), and disclosure of information to shareholders accurately, completely, adequately, transparently and in a timely manner (Duty of Disclosure).

In 2024, the Board of Directors reviewed and approved the strategic plan to drive and create growth for the Group to achieve business goals and diversification to keep up with current changes in line with future economic trends and directions. The Company also strengthens the foundation for sustainable growth and monitors the implementation of the strategy while maintaining the vision, mission, strategy and main goals according to the Triple S Strategy as follows:

- - Strength Strategy: Conduct business efficiently; Generate revenue and return for a strong foundation for the future; Aim to develop the organization towards excellence.

- - Synergy Strategy: Conduct an integrative business and expand cooperation with leading domestic and international partners; Increase opportunities for sustainable growth in the Power Business and Non-Power Business with potential of the business chain; Focus on innovation to expand and create added value in the future.

- - Sustainability Strategy: Support renewable energy; Caring for the environment, society, and corporate governance for sustainable security.

- Ensure the completeness and integrity of key corporate matters, including the review and approval of the Company’s vision, strategy, mission, and Code of Conduct, and communication to all employees through internal channels such as email, LINE application, and newsletter, to ensure awareness and adherence; review and approve annual financial reports to enhance shareholder confidence; ensure continuous and strict compliance with laws, regulations, article of association, Code of Conduct, and good corporate governance principles; maintain an appropriate proportion of independent directors to balance the power between management and/or major shareholders; oversee internal audit processes, internal control system and risk management, prevention of conflicts of interest, transactions between connected businesses, protecting the Company’s reputation and using resources in the most efficient and effective manner, while continuously supervising and monitoring compliance.

- Establish and approve the assignment of roles and duties of the Company’s sub-committees as appropriate and necessary.

- Establish criteria and annually evaluate the performance of the Board of Directors and sub-committees, both collectively and individually and disclose the performance in the form 56-1 One Report.

- Schedule of meetings and voting of the Board of Directors

- The Board of Directors’ meeting shall be held at least once a month and the date of the Board of Directors’ meeting shall be set in advance throughout the year so that the Board of Directors can allocate time to attend the meeting completely. In addition, the Company requires that a meeting of the Board of Directors only for non-executive directors shall be held at least once a year for the directors to consider and review the performance of the Board of Directors, management and operations of the Company, as well as to discuss various important management issues without the participation of executive directors and without the participation of the management. The Chairman of the Board of Directors will inform the Chief Executive Officer of the results of the meeting in order to adopt recommendations to improve and develop the operation to be more effective and achieve the Company’s goals.

- Refraining from attending meetings and voting on agenda items in which they have interests.

- Each director has one vote. Directors who have an interest in any matter shall not have the right to vote on such matter, in case of equal votes, the Chairman of the meeting shall cast another vote as a decisive voice.

- Schedule of meetings and voting of the Board of Directors

- The Board of Directors’ meeting shall be held at least once a month and the date of the Board of Directors’ meeting shall be set in advance throughout the year so that the Board of Directors can allocate time to attend the meeting completely. In addition, the Company requires that a meeting of the Board of Directors only for non-executive directors shall be held at least once a year for the directors to consider and review the performance of the Board of Directors, the Management and operations of the Company, as well as to discuss various important management issues without the participation of executive directors and the participation of the Management. The Chairman of the Board of Directors will inform the Chief Executive Officer of the results of the meeting in order to adopt recommendations to improve and develop the operation to be more effective and achieve the Company’s goals.

- Refraining from attending meetings and voting on agenda items in which they have interests.

- Each director has one vote. Directors who have an interest in any matter shall not have the right to vote on such matter, in case of equal votes, the chairman of the meeting shall cast another vote as a decisive voice.

- Board of Directors Meeting

- Principles and Guidelines for Board of Directors’ Meeting.

The Company focuses on the independence of directors’ decisions so that directors perform their duties with integrity and prudence, protect the interests of the Company, and always recognize that they represent shareholders and play a role in leading the organization to success. The Board of Directors shall formulate appropriate strategies and policies to increase competitiveness which reflects the growth of the organization, adding long-term value to shareholders, and being responsible to all stakeholders. In addition, they shall have a vision to formulate business strategies and play a role in overseeing the Group’s operations in accordance with the laws, objectives, resolutions of the shareholders’ meeting, articles of association, regulations, and principles of good corporate governance of the organization and related agencies.

- Meeting schedule, preparation of meeting agenda, and meeting documents

The Board of Directors schedules its meeting in advance within December of each year. In 2023, the Board of Directors during the October meeting scheduled the meeting for the whole year of 2024 once a month, every fourth Thursday of the month at 1:30 p.m., and in 2024, during the November meeting, the Board of Directors scheduled the meeting for the whole year of 2025 once a month, every fourth Tuesday of the month at 1:30 p.m. For all sub-committees, the meeting is scheduled in advance of the whole year according to the mission of each committee as well, so that the directors and the Management can plan the meeting in advance appropriately. Additional meetings may also be considered if there are important tasks and/or urgent needs other than those scheduled.

In order to ensure that important matters are brought to the Board of Directors’ meeting, the Chairman and the Chief Executive Officer will jointly consider the matters to be included in the agenda and notify the directors in advance together with the meeting invitation in a timely manner in accordance with relevant laws and requirements. However, directors are free to propose additional matters to the meeting agenda by giving 10 days’ notice in advance of the meeting date as notified in the invitation letter to every individual director. In case of urgent matters or emergencies that will affect the Company directly or indirectly, directors and/or independent directors can propose matters for consideration or notify for acknowledgement of other matters during the Board of Directors’ meeting.

The agenda of the meeting is categorized, and the meeting is carried out in an appropriate order, including matters to notify to the meeting by the chairman, endorsing of the minutes of the previous meeting, matters arising from the meeting, matters proposed for consideration, matters proposed for acknowledgement, and other matters (if any). In addition, matters to be proposed to the Board of Directors’ meeting on a regular basis such as monthly, quarterly, and annual agendas shall be determined in advance. The Management is also required to report on the Group’s performance analysis, including financial reports, asset management performance reports, and progress reports on key projects in which the Company is invested, report on changes in securities holding, and advance notification of securities trading for the Board of Directors to acknowledge, monitor, and follow up and/or solve the problems and obstacles to ensure timely implementation on a monthly basis.

The meeting invitation letter and meeting agenda will be sent to each director at least 14 days in advance of the meeting and the meeting documents must be sent at least 5 working days in advance to allow sufficient time to study the information before the meeting. Directors can ask the Chief Executive Officer and the Company Secretary for more details. For sub-committees, additional information related to the mission can be obtained from the Chief Executive Officer and the secretary to each sub-committee.

- Role of the Chairman, Directors, Management, and Meeting Atmosphere

- Chairman (Independent Director) Leads the meeting and ensure a 100% quorum at the time of voting (except for directors who have vested interest in such matters); allocate time to promote and encourage all directors to participate in discussions and express opinions freely and thoroughly, equally, appropriately, completely, and adequately; and summarize the resolution of the meeting every time.

- Directors: Participate in constructive discussion based on the information submitted by the Management and other relevant and necessary additional information, taking into account the benefits, impacts and risk factors in all dimensions, both to the Company and to the stakeholders, carefully in order to ensure that the resolutions of the meeting are appropriate, reasonable, and complete; fully dedicate time, knowledge and be able to perform duties as a director of listed company.

- Management: All high-level executives of all functions are responsible for attending the Board of Directors’ meeting and/or inviting related parties and advisors to attend the meeting to clarify specific details and provide information and clarify inquiries at the meeting. For presentation of information for consideration of the Board of Directors, relevant and necessary information must be presented accurately, completely, adequately, and timely in advance to provide directors sufficient time to study and consider carefully and appropriately.

- Meeting atmosphere and expression of opinions: The Company provides appropriate and adequate meeting equipment and facilities. The meeting atmosphere is facilitated, and all directors are given opportunity to participate in discussions and express their opinions constructively while the benefits and impacts on all stakeholders were considered carefully. The duration of each meeting is appropriated, averaging 2 to 2.5 hours.

- Meeting proceedings: Generally, in considering each agenda item, the Management will present the background, principles and rationales, relevant rules and regulations, necessity, relevant important information, consideration of sub-committees (if any), and the Management’s proposal for consideration and decision of the Board of Directors. The Chairman then allow the meeting time to discuss relevant issues completely and thoroughly, encouraging all directors to share their opinions and inquire the Management key issues for clarification further before finalizing the meeting’s resolutions.

- Directors with vested interest on specific item cannot vote on that matter. Before the start of every meeting of the Board of Directors, the Chairman shall inform the meeting that directors who have vested interest in any agenda item shall inform the meeting and leave the meeting on that agenda item and do not have the right to vote on such matter. Before starting to consider that agenda item, the directors who have vested interests will notify the meeting and leave the meeting. The Company has always strictly adhered to this practice.

- Consideration of related party transactions and transactions that involve or may involve conflict of interest: The Company has established a policy requiring independent directors to review related-party transactions or transactions that involve or may involve conflict of interest. The Board of Directors considers such transactions based on the Audit Committee’s approval, ensuring that they are necessary, reasonable, and in the best interest of the Company. It is comparable to similar transactions of the same nature in general, including paying attention to the steps taken and disclosing information correctly and completely in accordance with relevant laws and regulations

- Preparation and storage of meeting minutes

- Company Secretary is responsible for the preparation and storage of the meeting invitation letter, minutes of the Board of Directors’ meeting and shareholders’ meeting, as assigned by the Board of Directors.

- Meeting minutes are prepared in writing with complete essential information such as date and time of the start and end of the meeting, meeting venue, list of directors and executives attending the meeting, list of directors absent, summary of the matters proposed to the meeting, summary of the matters being discussed, comments and observations of directors, and resolution of the meeting with signatures of the minute taker and the Chairman of the meeting. The draft minutes of the meeting are completed and reviewed by the Chief Executive Officer within approximately 3 working days after the meeting date and propose to all directors for revision within a period of 7 days and/or as urgently needed. Thereafter, the draft minutes of the meeting shall be deemed to have been initially approved by the Board of Directors and shall be carried out in accordance with the resolutions of the meeting. The meeting minutes shall then be proposed to the Board of Directors for official approval at the next meeting.

The Company deploys both paper-based and electronic formats for the management and storage system of the Company’s archives, such as documents related to the Board of Director’s meeting and shareholders’ meeting, to facilitate the usage and reduce global warming. The Company reports the storage facility in accordance with the requirements of the SEC. The Company has strong safeguards in place to protect both forms of documents, such as limiting number of meeting attendees; Designate the person responsible for accessing each type of important document in accordance with the confidential information handling policy; Assign user ID according to cyber security system. In addition, an automated central backup system is in place at the central office and sub-offices to support emergencies and prevent impacts on the Group’s operations.

- Dissemination of meeting resolutions: The Chief Executive Officer as the Secretary to the Board of Directors communicates the resolutions of the Board of Directors’ Meeting and/or the resolutions of the Shareholders’ Meeting in writing to the Chief Executives of all functions for acknowledgement and/or consideration and/or notification to relevant departments to implement the resolutions of the Board of Directors and/or the resolutions of the Shareholders’ Meeting. In addition, progress of the implementation will be monitored and reported to the Board of Directors as appropriate.

- Principles and Guidelines for Board of Directors’ Meeting.

- Performance assessment

- Assessment of Director Performance

The Company requires the Board of Directors and all sub-committees of listed companies to conduct a self-assessment at least once a year in December. The assessment was conducted both collectively and individually for the Board of Directors and sub-committees to review performance and identify areas for improvement. This evaluation aims to enhance the effectiveness of the Board and sub-committees, ensuring alignment with good corporate governance principles for listed companies and the Company’s regulations on the Board of Directors. The results of the assessment are disclosed in the Company’s Form 56-1 One Report. In addition, the assessment results are used to promote and develop specific knowledge and competencies for individual directors.

The performance assessment evaluates the overall effectiveness of the Board of Directors and each sub-committee, both collectively and individually, covering key areas aligned with good corporate governance principles for listed companies. The evaluation considers the following key factors:

- Board of Directors readiness.

- Strategy formulation, business planning, and budgeting.

- Separation of roles, duties, responsibilities and delegation of authority.

- Supervision and monitoring.

- Human resource management.

- Risk management, internal control, and conflict of interest.

- Communication with the Company’s stakeholders and the public.

- Board of Directors meeting.

Self-assessment of all sub-committees is overall assessment “collectively” and “individually”. Factors for assessment consisted of

- Sub-committees’ readiness.

- Meetings of the Sub-committees.

- Roles, Duties and Responsibilities of Sub-Committees.

In 2024, the Board of Directors reviewed the self-performance assessment form for the Board of Directors and sub-committees, both collectively and individually, based on the approved endorsement by the Human Resources and Remuneration Committee, which is still up-to-date and in line with the context of their roles and the Company’s business operations. The Company will utilize the results of performance assessment of the Board of Directors and sub-committees as a guideline to promote and allocate training courses to further develop the knowledge and competencies of individual directors. This initiative aims to enhance the overall efficiency of both the Board of Directors and sub-committees in carrying out their responsibilities.

- Top executives’ performance assessment (Chief Executive Officer)

The evaluation is conducted twice a year, in June and December, by each director according to the predetermined form and evaluation criteria. The evaluation criteria are divided into 2 aspects: the evaluation based on the Company’s annual KPI approved by the Board of Directors (weighted 70%) and the competency evaluation (weighted 30%).

- Assessment of Director Performance

- New director orientation and the development of directors and executives

- Newly appointed directors

will be required to attend an orientation where they will be briefed by the Chief Executive Officer on the Company’s overall operations and good corporate governance. They will receive important documents to prepare for their duties as directors of the Company covering various matters, including the Company’s regulations and Articles of Associations; the Company’s Code of Conduct; structure, authority and duties and composition of the Board of Directors and sub-committees; remuneration; and key policies related to directors such as corporate governance, anti-corruption, prevention of conflict of interest, prevention of misuse of inside information, handbook for directors of listed companies, and information on compliance with requirements of the listed companies regulatory agencies.

- Directors’ development:

The Company has proposed courses relevant to directors and supported important trainings/seminars organized by related organizations such as IOD, SET, Thailand Energy Academy. The seminars and/or field trips have also been organized annually for the Board of Directors, both domestically and abroad. The objectives are to enhance understanding of roles and responsibilities; promote skills in performing duties as directors of listed companies; as well as promote and develop knowledge, capability, skills, and important experiences for the Board of Directors to further develop the business sustainably. Moreover, important corporate governance policies and practices are communicated, such as misuse of inside information, conflict of interest, anti-corruption, and guidelines of listed companies regulatory agencies through internal communication channels such as email, LINE application, and/or internal activities of the Company continuously.

- Newly appointed directors

- Succession Plan for High-Level Executives

The succession plan for the Chief Executive Officer follows the policy of EGAT, the Company’s major shareholder. EGAT selects its executive who has appropriate qualifications, knowledge, and capability beneficial to the Company and nominates the person to the Board of Directors. The screening and nomination process are handled by the Human Resources and Remuneration Committee in accordance with the Company’s nomination procedure and aligned with the Success Plan for High-Level Executives established by the Board of Directors.

For the succession planning of other executive positions, the Company has prepared the career path for all positions that encompasses systematically designed competency development (Competency Model), starting from the analysis of competency and desirable qualifications for each position. This model is aimed at developing and selecting qualified persons and aligned with the employee promotion, demotion, dismissal, transfer, and development process, to support the Company’s business expansion in both the present and future, in line with its vision and mission.

- Reporting of directors’ and executives’ interests

The directors and executives are required to submit a vested interest report, concerning themselves and related persons, on the first day of assuming the position and whenever there is a change in their interest using the prescribed Conflict of Interest Disclosure Form. The Company Secretary is responsible for maintaining these reports and forwarding copies to the Chairman of the Board of Directors and the Chairman of the Audit Committee. Subsequent reports must be submitted at least once a year on 1 June.

- Transaction that involves or may involve conflict of interest

The Board of Directors provides a guideline in handling conflict of interest transparently and accountably, which is included in the Company’s regulation on the Board of Directors. The guidelines state: “Directors with vested interest in any particular issue shall not have the right to vote on the issue”. The Board strictly complies with the regulation. The Board of Directors and the Audit Committee have an important role in formulating measures to handle and prevent conflict of interest and supervising the operations in a reasonable manner. This includes the disclosure of complete information in accordance with related regulations for the overall benefit of the Company. Based on the Audit Committee’s screening and approval, the Board of Directors ensures that related party transactions between the Company and subsidiaries are done for the benefits of the Company and subsidiaries. Accurate and complete disclosure of such transactions is required according to relevant regulations. The Board of Directors provides a guideline in handling conflict of interest transparently and accountably, which is included in the Company’s regulation on the Board of Directors. The guidelines state: “Directors with vested interest in any particular issue shall not have the right to vote on the issue”. The Board strictly complies with the regulation. The Board of Directors and the Audit Committee have an important role in formulating measures to handle and prevent conflict of interest and supervising the operations in a reasonable manner. This includes the disclosure of complete information in accordance with related regulations for the overall benefit of the Company. Based on the Audit Committee’s screening and approval, the Board of Directors makes sure that related party transactions between the Company and subsidiaries are done for the benefits of the Company and subsidiaries. Accurate and complete disclosure of such transactions is required according to relevant regulations.

- Directors and Officers Liability Insurance

The Board of Directors requires the Management propose the Directors and Officers Liability Insurance (D&O) for its consideration on an annual basis, to protect directors and Chief Executive Officer from lawsuits filed as a result of their earnest actions for the Company. The proposal must contain insurance conditions and premiums. Such lawsuits are possible as the Company’s business portfolio has been expanded, resulting in massive business transactions that directors and Chief Executive Officer must dutifully endorse, give opinions, guarantee or involve with. The insurance is necessary as directors and Chief Executive Officer may receive lawsuits from outsiders like shareholders or other stakeholders that hold them liable to claims for their actions. However, the directors and Chief Executive Office will not be covered by the insurance for malpractices and they must be responsible for all expenses incurring from the legal process.

5. Code of Conduct

The Company is committed to ethical principles, and integrity, conducting its business in accordance with good corporate governance and its established Code of Conduct. This Code of Conduct consolidates best practices that align with legal and regulatory requirements and serves as a standard guideline for directors, executives, employees, and relevant stakeholders in conducting business responsibly. It also encompasses key principles that impact stakeholders across the Company’s value chain, which are essential for achieving sustainable business success. The Code of Conduct covers various key areas, including the Company’s vision, mission, values, and business commitments, compliance with ethical standards, whistleblowing and complaint procedures, protection against retaliation, and remedies for whistleblowers, complainants, or those cooperating in reporting violations. It also covers business operation guidelines, stakeholder engagement, operational excellence, data protection, asset and financial management, human rights, information disclosure, and environmental responsibility. The Board of Directors meeting no. 14/2024 on 19 December 2024 reviewed the Company’s Code of Conduct and approved updates, including enhancements to the procedures for handling complaints. Furthermore, modifications and revisions were made to ensure the Code of Conduct remains comprehensive, aligned with the current business environment, and relevant to the Company’s operational context. The Company has actively communicated and raised awareness of business ethics by distributing the updated Code of Conduct to all directors, executives, and employees, requiring them to formally acknowledge it. Furthermore, assessments have been conducted to evaluate employees’ knowledge and understanding of the Company’s Code of Conduct.

| The Code of Conduct |

In 2024, no violations of the Company’s ethics or Code of Conduct were reported. Any breach or misconduct related to the Code of Conduct would be subject to disciplinary action in accordance with company regulations and, if the act is unlawful, may also result in legal consequences

6. Communications and monitoring of compliance with the corporate governance policy and business ethics